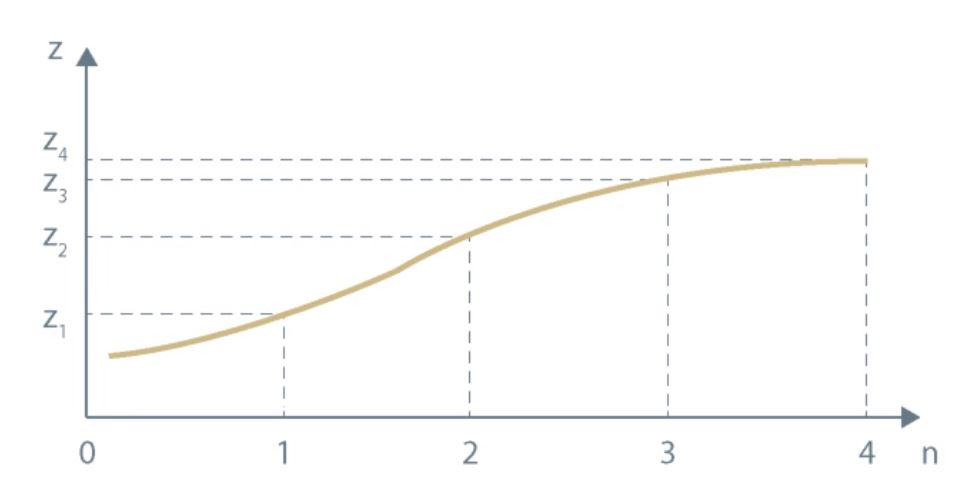

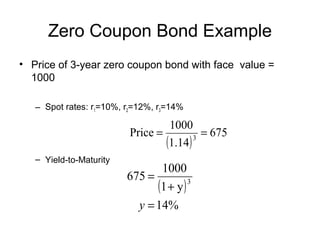

1: Zero coupon bond prices, spot and forward interest rates, and spot... | Download Scientific Diagram

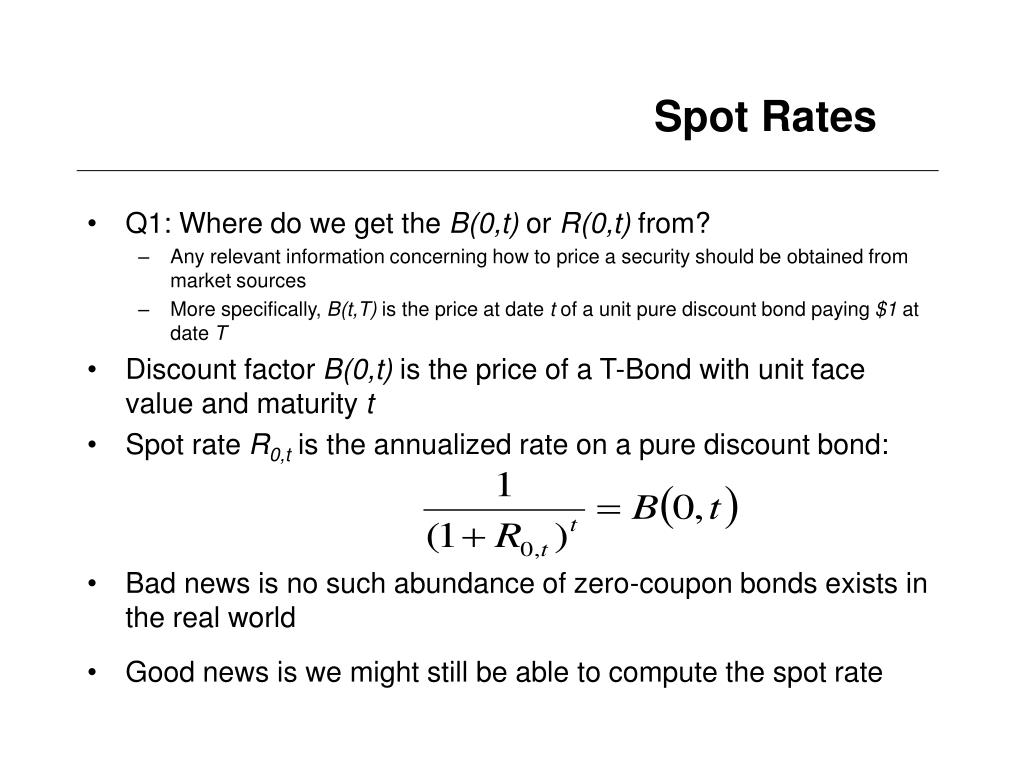

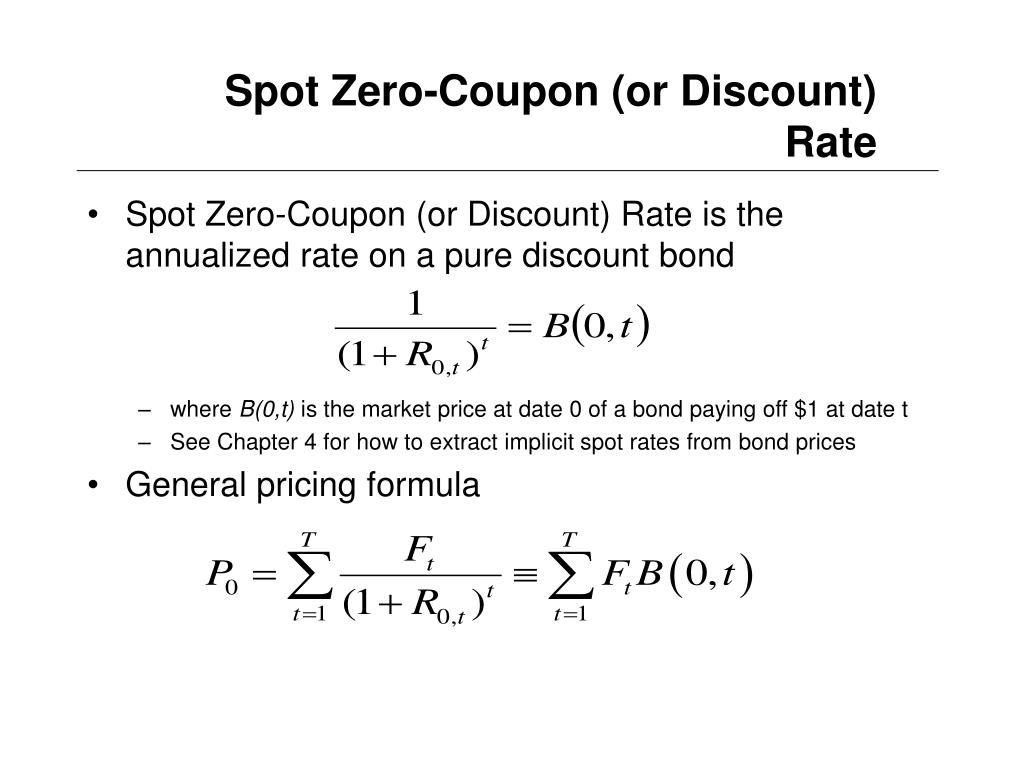

Calibration of simply compounded spot rates, forward rates, and zero... | Download Scientific Diagram

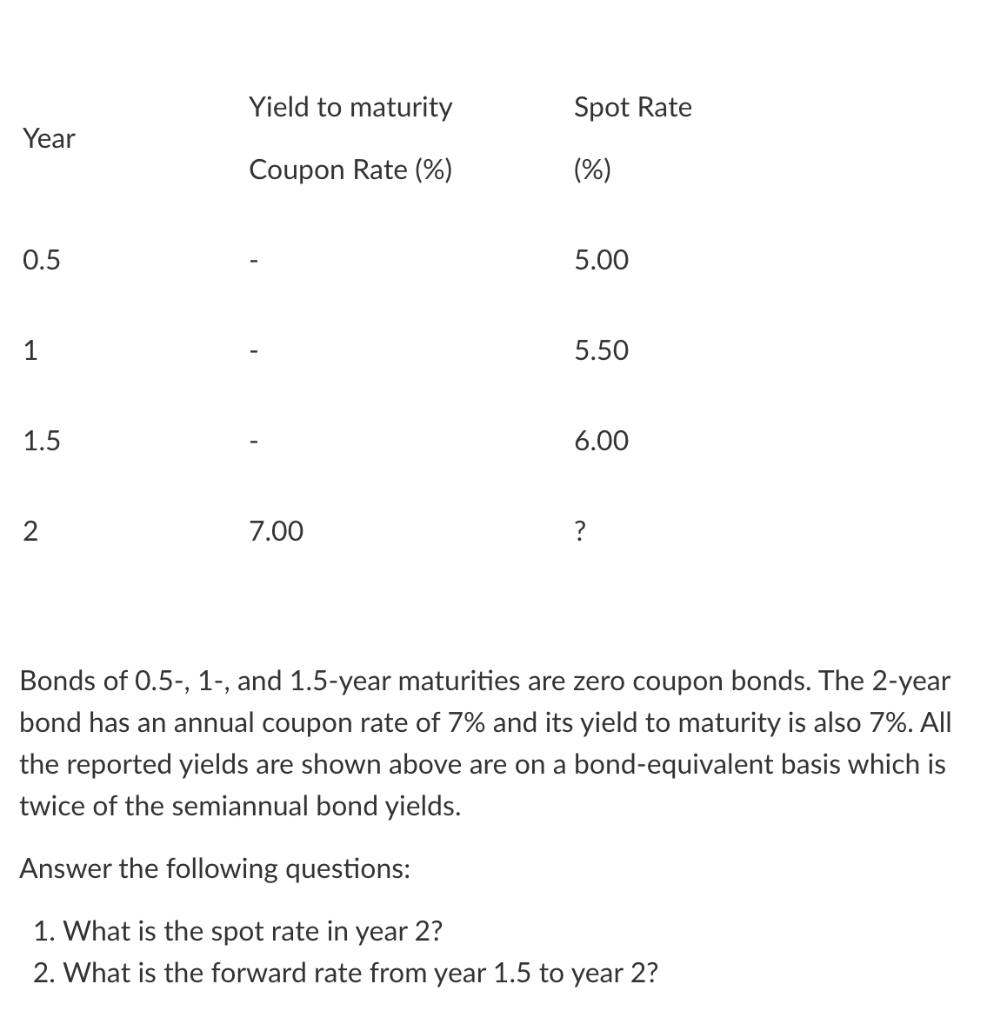

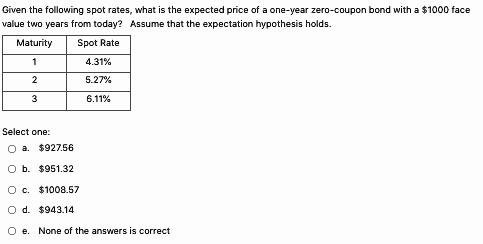

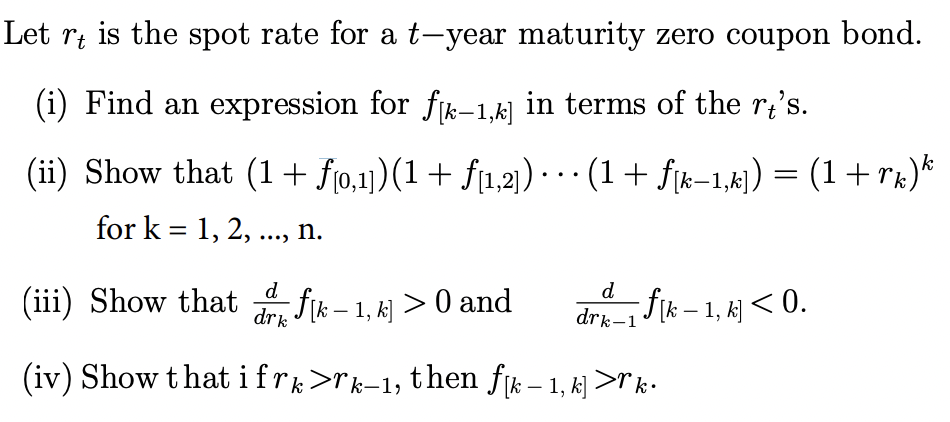

SOLVED: Given the following spot rates, what is the expected price of a one-year zero-coupon bond with a 1000 face value two years from today? Assume that the expectation hypothesis holds. Maturity

Quantitative easing (QE) impact on zero-coupon yield curve spot rate of... | Download Scientific Diagram

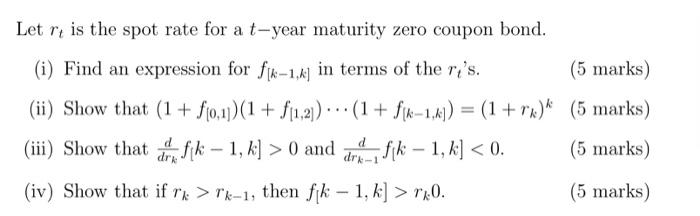

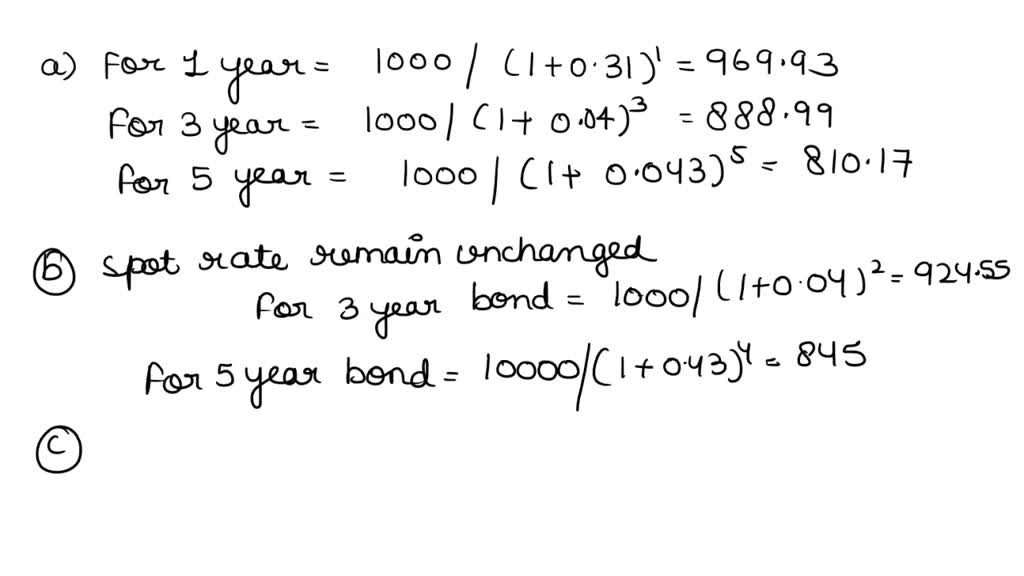

SOLVED: An investor is considering the purchase of zero-coupon bonds with maturities of one, three, or five years. Currently the spot rates for 1-, 2-, 3-, 4-, and 5-year zero-coupon bonds are,

:max_bytes(150000):strip_icc()/GettyImages-810720992-f4dcb14dc2674174a84be79d0d538f85.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)